Considering buying a rental property? Real estate broker, investor, and personal finance expert Keith Prescott knows exactly what numbers to look at to estimate cash flow. The goal is profit, and he knows how to achieve that in Buncombe County!

Can you look at a property listing and know if it’s a good investment? Yes – if you follow Keith’s formula. Read on for two real-world examples of property in Buncombe County. Above all, Keith notes that there are lots of variables to consider. Don’t blindly follow rules, but keep the framework in mind and lean on mentors and experienced folks to guide you.

When buying a property, you have to ensure the cash flow is worth it. Keith suggests you aim for a long-term rental first. If you assume from the beginning you can rent the property short-term (like an AirBnb, at a higher profit), this is unnecessarily risky.

Due to property prices in Buncombe County, double and singlewides are usually the only properties worth buying and holding for long-term rental, so this is the type of property he uses as examples.

How to estimate cash flow when looking at a listing

Glance at the list price, but don’t let that deter you. It’s the last thing Keith looks at. A home is worth what you’re willing to pay for it and what the renters will pay. Run all the numbers first and see what makes sense to buy it at, then make an offer.

Keith’s first example property has a $100,000 list price. It’s a 2,000-square foot doublewide in Leicester with 3 bedrooms and 2 baths. It was built in 2000, and mobile home standards jumped in the late ‘70s and again in the ‘90s, so less renovation will be needed to bring this home up to code. The home comes with one acre of land. Despite the great view on the property, this home is pretty far from Asheville. Keith also takes pause when reading that there is a 3-bedroom septic but it’s in use as a 4-bedroom – there are risks involved there.

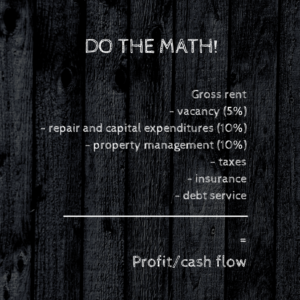

He estimates that he could get $1500-2,000/month in rent. To run the numbers, Keith considers the lower amount. Then, subtract the following costs from that gross amount.

- Vacancy, estimated at 5% (it’s often closer to 2-3% for a pro like Keith). This is due to tenant turnover. When the property is vacant, it usually needs repairs. In addition, looking for a new tenant will take time, which reduces cash flow.

- Repair costs, estimated at 10%. If the big systems are in good shape, you can assume a 10% repair cost. To estimate repairs, Keith combines capital expenditures like roof and hot water heater with more routine fixes like carpets and plumbing.

- Property tax. Based on other properties in the area, we’ll say $50/month.

Insurance – another $50/month. - Property management should be in your projections at 10%, even if you plan on managing on your own. In the future, you may want to scale and transfer this job to someone else or a company.

- Mortgage/debt service. We’ll estimate this at around $500-600/month. If you borrow 100k and leverage 80k, that will put payments at 400/mo in debt service plus tax & insurance. When getting the loan, the bank will credit you 75% of the lease as income. If banks use this expense ratio, that’s a good way to look at it. If paying cash, it’s different than leveraging. Let’s assume it’s a 30-year fixed loan from the bank.

Keith won’t invest unless he’s getting a 20% return. By using this formula, this property is a good deal. Once you determine that, lock into a contract as low as possible. Run the numbers again with confirmed tax and insurance amounts. Get multiple quotes and compare them. Check with your banks and lenders to make sure the mortgage payment estimate is correct and understood.

For more details on mortgages and all these numbers, listen to our podcast episode with Keith.

The second example property Keith introduced is in Candler, North Carolina. It’s a much smaller trailer home, at 825 square feet. It is a 3 bedroom, 2 bath home, and it’s listed for $130,000. Due to the size, Keith only estimates rent being in the $900-1100 range.

After calculations, this property only brings a $200/month cash flow. This is under 10% return, which gets a no from Keith.

If it wasn’t a trailer, it would sustain equity better. For singlewides, banks offer limited loans and won’t offer a home equity line of credit, a great tool for investors. On a doublewide, you can get a traditional loan but no home equity line of credit. However, there are other options. Either way, it’s vital to get a plot of land along with the mobile home. Trailers in rented lots are not secure investment properties.

Insider tips to remember

When it comes to rent, lower your expectations. Since properties are renting fast and prices going up in Buncombe county, landlords often price their rentals at the top of the market price. But if your rent is high, turnover is expected more often. Every year when lease is up, tenants will look for a better deal. Then you’ll have to repair the property, and find a good tenant.

When asked about the saying, “There’s no such thing as a bad tenant, just a lazy landlord,” Keith said that’s false. Yes, a lazy landlord will have a higher ratio of bad tenants. But great landlords still end up with bad tenants, even with due diligence. Unexpected things happen!

When searching for a tenant, Keith suggests finding individuals with a credit score above 660. Another tip – look in their car. Is it full of trash? Your property will be, too, if you rent to them.

At the end of the day, be wary, conservative, and be surprised. “Don’t expect what you don’t inspect.” Get bids, confirm all numbers, and call people that know the area and market. Search for a property manager that takes their fee off the net and not the gross. Keith recommends Anna Connor at Rent 828. she knows what a property will rent for and is very reliable.

“The #1 number in your life that you want to track if you want to become wealthy is your net worth.”

Contact Keith at 828-808-3288 or [email protected]

Other than finding a good investment broker to help you through, Keith recommends reading ABCs of Real Estate Investing by Ken McElroy and The Millionaire Real Estate Investor by Gary Keller.